Last updated December 19, 2024

Loss aversion is a theory that states that the pain of loss is much stronger than the satisfaction of getting or winning something. Loss aversion is also known as loss aversion. This theory was first described by Daniel Kahneman and Amos Tversky in 1979. In this article you will read more about what loss aversion is and we will show examples. We also show how to apply loss aversion in online marketing.

Loss aversion meaning. What is loss aversion?

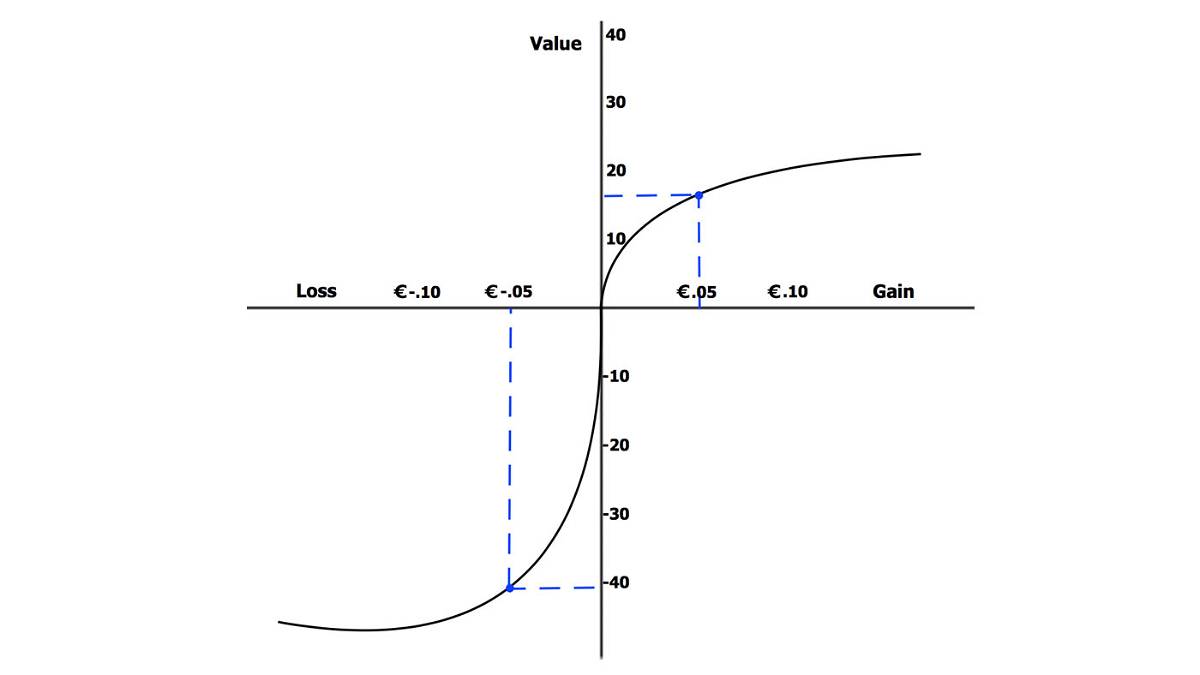

Loss aversion or loss aversion is the phenomenon that people experience the pain of losing something, for example money, 2 times more strongly than the satisfaction of getting or winning something. Losing 1000 Euros hurts people, in general, twice as much as the pleasure of getting 1000 Euros. This phenomenon is shown graphically in the following figure.

The graph shows that the negative perceived value of 5 euro loss is greater than the positive perceived value of 5 euro gain.

Psychologists Daniel Kahneman and Amos Tversky first described this phenomenon in 1979 in their paper "Prospect theory: An analysis of decision under risk. From this paper comes the statement "Losses loom larger than gains," or losses are larger than gains. This implies that people will naturally avoid loss. Loss aversion becomes stronger as the value or stakes of a choice increase.

Loss aversion example. What choice would you make?

We give an example of loss aversion to clarify the theory. Suppose you can choose between getting 10,000 euros with certainty or having a 25% chance of receiving 50,000 euros. Most people will choose certainty and want to get the 10,000 euros. However, the expected value of the other choice is greater, namely 12,5000 euros (25% of 50,000 euros). Therefore, rationally, this would be the best choice. The larger the amounts the greater the effect of loss aversion. Thus, if people are given the choice between getting 100,000 euros for sure or having a 25% chance of getting 500,000 euros, even more people will choose certainty.

Prospect theory: under uncertainty, humans are not rational

Loss aversion is part of prospect theory, or prospect theory. This theory, also introduced in the 1979 paper mentioned above, states that when faced with uncertainty, people make decisions that depend on circumstances. As a result, the estimates people make for opportunities and risks are not rational. People take greater risks in terms of loss compared to gain where people choose certainty. This is called the certainty effect.

Prospect theory was a break from the 1738 rational-choice theory that had been the standard in the social sciences until then. The rational-choice theory posits that humans make logical, rational trade-offs that focus on the maximum achievable for the individual. In the rational-choice theory, man makes no distinction in the value of loss or gain.

Loss aversion/loss aversion bias. People make non-rational decisions.

So because of loss aversion, people make non-rational decisions and this is called the loss aversion bias. In the aforementioned example, people often do not make the rational decision and choose the sure 10,000 euros. This is called the loss aversion bias.

How to apply loss aversion in marketing.

You can apply loss aversion bias in your marketing to get people to make certain choices. We give some examples of this.

Give people a sense of ownership: the Endowment effect

When people feel they own a product, they are more likely not to want to lose it. This is due to the endowment effect, also known as ownership effect. The endowment effect is a theory that states that when people own an item or have a sense of ownership, they value this item more than it is really worth.

For example, you can apply the endowment effect in the following ways.

- Offer a trial version or trial period. Chances are that people will not return the product after the trial period.

- Give users virtual property that they can lose. For example, this works well in apps where users earn badges if they use the app daily and lose the badge if they skip a day.

- Give away gifts under certain conditions. An example is a gift that customers get when they order for 50 euros in a webshop. If they then remove an item from the cart, you can show the message "If you remove this item from your cart, you will lose your free gift.

Create urgency

By creating urgency and making people feel they could lose something if they don't act now, people are more likely to buy something or - in online marketing terms - convert. Some well-known examples:

- Show a limited supply: only one room is still available.

- Offer a temporary promotion: this offer is valid today only.

Creating scarcity is also one of psychologist Cialdini's 7 principles of persuasion.

Framing loss as a message

When promoting a product, you can name the benefits of the item. You can also capitalize on loss aversion by communicating what a potential customer may lose if they do not choose your product.

- The message "Save 100 euros now" often works better than "Earn 100 euros now.

- For an anti-wrinkle cream, the message "Don't want to lose your smooth skin?" may work better than "Maintain your smooth skin.

Loss aversion critical

The theory of loss aversion is not embraced by everyone in science. For example, there are several studies in which the effect of loss aversion was not measured. For example, some scientists think that loss aversion depends on the size of the value and does not apply to small values. Other scientists claim that the effect of loss aversion in general is smaller than Kahneman and Tversky thought.

As with all theories, whether it works for specific situations must be proven in practice. Tasmanic therefore works with continuous A/B-testen, in which different versions are examined based on hypotheses. A/B testing is an important part of conversie-optimalisatie.

Are the results from your online marketing disappointing?

Request our no-obligation performance scan and we'll tell you where you're going wrong.

Team

Team FAQ

FAQ Vacancies

Vacancies Contac

Contac AWR

AWR Ahrefs

Ahrefs Channable

Channable ContentKing

ContentKing Leadinfo

Leadinfo Optmyzr

Optmyzr Qooqie

Qooqie Hubspo

Hubspo Semrush

Semrush