Last updated December 19, 2024

Introduction

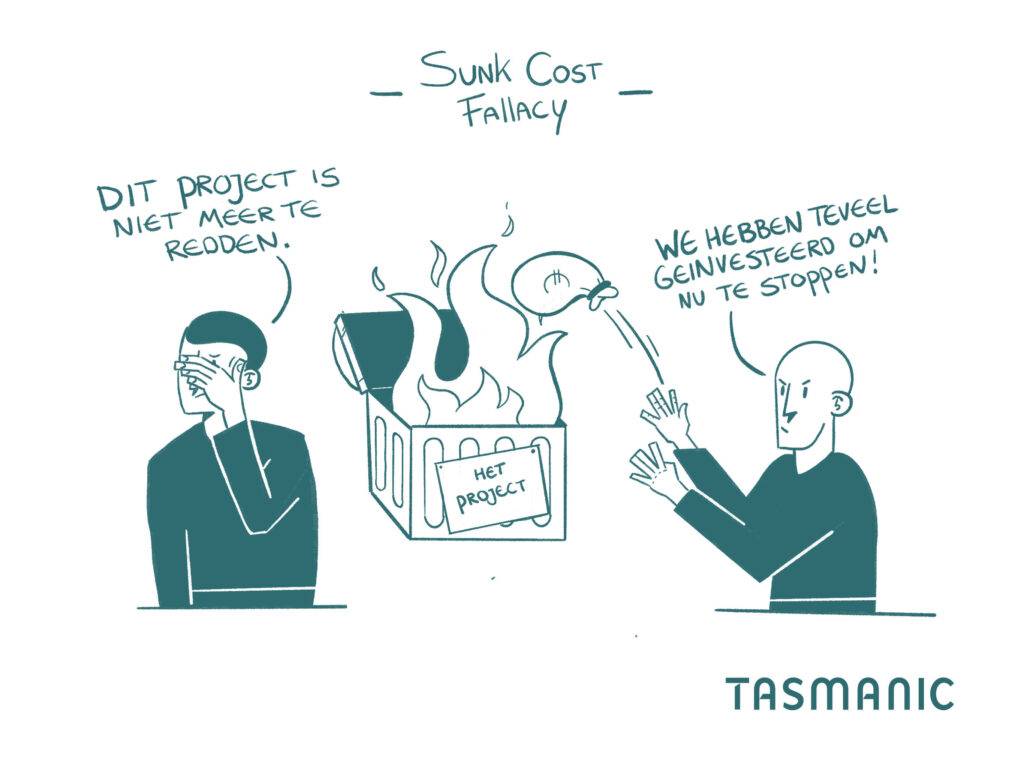

The Sunk Cost Fallacy represents a major pitfall for companies making investments and the people who work there. And every organization will face this at some point, as it involves investments of money, time and effort. When you better understand the Sunk Cost Fallacy, you can ensure that you make better decisions. That's why we'd like to give you some tips as an entrepreneur!

What is the Sunk Cost Fallacy?

The Sunk Cost Fallacy is the tendency to continue with something when an investment of money, effort or time has been made (Arkes & Blumer, 1985).

Even if the current situation actually shows that it no longer makes sense, your investments motivate you to keep going with it. Otherwise, it would be a waste of the money, time or effort you've already put into it, right? Researcher Richard Thaler first described the influence of "sunk costs. If a customer has to pay to use a service or product, he tends to continue with it longer (Thaler, 1980).

The Sunk Cost Fallacy is a mental fallacy, because sometimes it is better to stop after all. 'Better to be half right than half wrong' is a well-known saying. It is sometimes better to pull the plug on something in a timely manner, rather than stubbornly continue because of your previous investments. The Sunk Cost Fallacy is also known as the Concorde effect, because of the airplane in which governments continued to invest millions, even though it was clear all along that it would never be profitable.

How come we actually think this way?

Decision-making is not merely rational and is influenced by our emotions. Failure to implement a decision can lead to feelings of shame, guilt, reputational damage or remorse. In this regard, the Sunk Cost Fallacy bears similarities to the endowment effect, where we find it difficult to say "no" when we feel it is already ours, and the loss aversion, where the impact of loss outweighs the impact of gain for us. Despite advancing insight, we make irrational choices.

Practical examples

The Sunk Cost Fallacy becomes clear in the example below:

A few months ago you bought a concert ticket for €150. That's a lot of money, but you're really looking forward to it. Unfortunately, on the day of the concert it's raining cats and dogs and you don't feel very well. Moreover, huge traffic jams are expected towards the concert location: what do you do then?

If you do go, you probably fall into the Sunk Cost Fallacy. Because, suppose the ticket had been free, would you also go and stand in a traffic jam for hours while feeling unwell, to go to a concert in the rain? If the answer to that is no, you shouldn't go now either, despite the fact that the ticket cost you €150.

After all, you've already incurred those costs. Whether you go or not, you've already lost the money. What you do have a say in is what your day looks like. You can join the traffic jam and then stand in the rain. Or you can stay comfortably on the couch, with a hot cup of tea. It's not a waste of the concert ticket (and expense) if you don't go. It's actually a waste of the potentially more enjoyable or comfortable day if you do go.

An example in business

At the individual level, the Sunk Cost Fallacy often does not lead to major consequences. With companies, however, it is a risk, just as it was with the government at the time with the Concorde. Imagine, for example, that you have been investing for 3 years in a revolutionary new aircraft that flies faster than what we currently know. You are putting tens of millions into it as a company.

You need to invest another two million over the next year to put the plane into production. But, you unfortunately just find out that there is a competitor who has developed an even much better model that comes to market at the same time and offers more advantages than your model on all fronts. What do you do then?

Then when you do invest two million to put the plane into production, you fall into the Sunk Cost Fallacy. 'But, otherwise it's a waste of the earlier investments, isn't it?' You have already made the earlier investments; the two million you now want to invest extra can still be kept in your pocket. If you already know that the plane will be overtaken by the competitor, it is better not to keep investing in it, despite all the previous years' investments you have already made.

Using Sunk Cost Fallacy to your advantage

Do you want to invest within SMEs, for example in technology or even specifically the Metaverse? It's not a good idea to keep pushing through an investment at all costs. Notice something isn't working? Dare to pull the plug. The same goes for collaborations with partners. Sometimes it's better to quit halfway through than to keep going at it endlessly. Every extra day you keep going then costs more, when it wouldn't have been necessary. But as an entrepreneur, how do you avoid falling into the Sunk Cost Fallacy?

Focus on the short term

Rather choose a project that provides value in the short term, on which you can build, than one that will not provide value for several years, and may be obsolete in the meantime.

Look Ahead

'Sunk costs' are 'sunk,' so those amounts and hours incurred must be put behind you. Stay critical of opportunities, looking only ahead. Do not consider investments made earlier. Those costs have been paid and won't come back anyway. Sometimes it is better to cancel a new investment, even if it means that the previous investments were for nothing. A new investment in a project that no longer seems promising would only lead to higher costs in the future.

Are you working on a new IT environment, investing in a new machine or have employees been working on a new way of working for years? Keep going with that only if it's still a good idea. Don't be guided by what you've already done if you already know it's no longer the right way forward. Of course you take into account any opportunity costs when mapping out your company's finances. At the same time, it is important to only look ahead when making new investment decisions.

Verify a new idea

With a new idea, ask yourself: does it solve an existing problem in the marketplace?

- Let potential customers make an initial investment in advance. Ask them to make a down payment, ask them to invest time, or get them to put effort into a new product or service. That way, verify that there is a real need.

- Use a proof of concept to find out in practice if something works.

Consider that customers also think this way

Not only you as a business owner will have to deal with the Sunk Cost Fallacy. Your customers, too, will make or abandon certain decisions because of the Sunk Cost Fallacy. You can make this work to your advantage:

- Offer a service or product in multiple parts. If a customer has already purchased parts 1 and 2, he will be more likely to purchase part 3 as well because there has already been an investment of time, money and effort.

- Offer a service in subscription form, working with a minimum number of months. After that, it can feel harder to cancel.

- Make a product cheaper the more of it you buy. For example, let the 2nd scoop of ice cream be cheaper than the 1st. Emphasize that for just a small investment extra, you get double!

- Remind clients regularly of your long-standing partnership.

- Emphasize that if you have already gotten this far, you can complete your purchase in just 2 clicks, for example.

Resources

Arkes, H. R., & Blumer, C. (1985), The psychology of sunk costs, Organizational Behavior and Human Decision Processes, 35, 124-140.

Jarmolowicz, D. P., Bickel, W. K., Sofis, M. J., Hatz, L. E., & Mueller, E. T. (2016). Sunk costs, psychological symptomology, and help seeking. SpringerPlus, 5(1), 1-7. https://doi. org/10.1186/s40064-016-3402-z

Thaler, R. (1980). Toward a positive theory of consumer choice. Journal of Economic Behavior & Organization, 1(1), 39-60. https://doi. org/10.1016/0167-2681(80)90051-7

Is your company missing opportunities?

Our pay is based on your results.

Team

Team FAQ

FAQ Vacancies

Vacancies Contac

Contac AWR

AWR Ahrefs

Ahrefs Channable

Channable ContentKing

ContentKing Leadinfo

Leadinfo Optmyzr

Optmyzr Qooqie

Qooqie Hubspo

Hubspo Semrush

Semrush